Explainers

Reconciliations

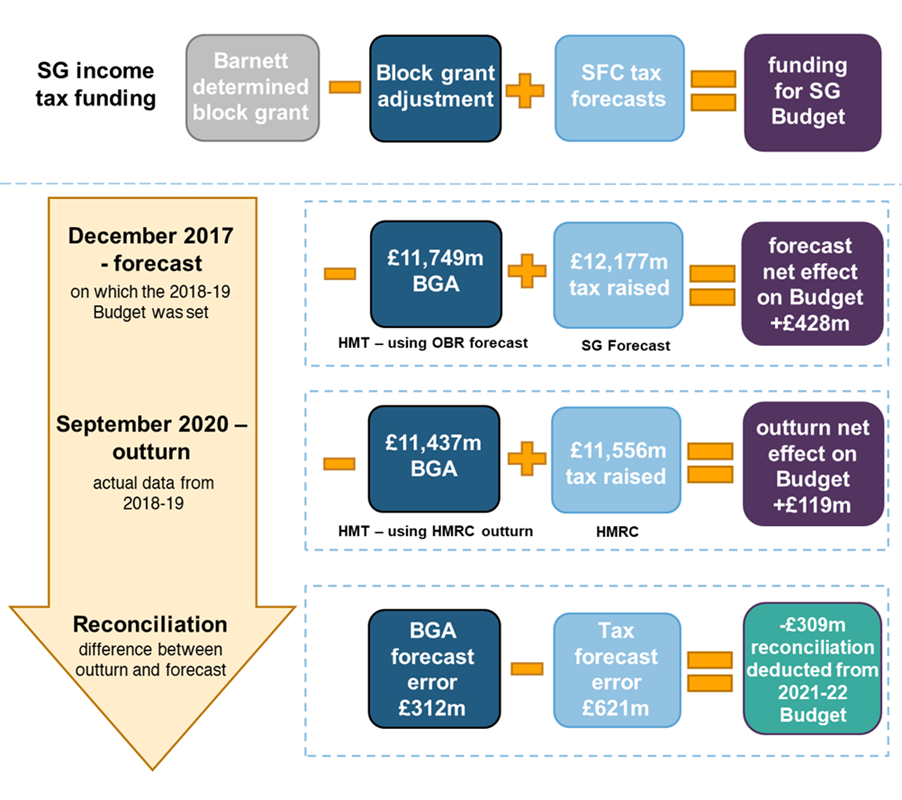

The Scottish Budget is set in advance of each financial year, based in part on Scottish Fiscal Commission (SFC) and Office for Budget Responsibility (OBR) forecasts.

Because so much of the funding for the Scottish Budget is now based on forecasts, there is a recurrent process of adjustments called reconciliations.

Income Tax

For each Scottish Budget, the SFC’s forecasts set the amount of Scottish Income Tax revenues we think HM Revenue and Customs will collect. The UK Government transfers that amount to the Scottish Government.

The OBR forecasts the Income Tax revenues HM Revenue and Customs will collect for England and Northern Ireland. These are the basis for the Income Tax Block Grant Adjustments (BGAs), which deduct funding from the Block Grant.

Because Income Tax is so large and there is a long delay until outturn data is published, its net position – that is, the difference between forecast revenues and the forecast BGA – is locked using the budget-setting forecasts. Even if later forecasts from us or the OBR point to some forecast error, it is only revisited once outturn data is available.

Outturn data takes two years to be available. Once published, Income Tax revenues in Scotland, England and Northern Ireland are known, so a final BGA can be calculated. The difference between the net position that set the Budget and that which results from outturn data is applied as a reconciliation.

The reconciliation applies at the next possible Budget. The long time it takes for outturn data to be released means there is a lag of up to three years when applying reconciliations. For example, the Income Tax reconciliation worth ‑£309 million applied to the 2021-22 Budget related to Income Tax collected in 2018-19. The following diagram shows how this reconciliation came about.

Fully devolved taxes and social security

Ahead of the Scottish Budget, we also forecast how much we think Revenue Scotland will collect in fully devolved taxes for that year, as well as how much Social Security Scotland and the DWP will pay in devolved social security.

As with Income Tax, the OBR forecasts the equivalent UK Government tax revenues and social security spending where they are not devolved (England and Northern Ireland for fully devolved taxes, England and Wales for social security). These are used to calculate the corresponding BGAs.

Unlike Income Tax, though, fully devolved tax revenues, social security spending, and their corresponding BGAs are all revised at different times.

- The Scottish Government manages any forecast error on fully devolved tax revenues and social security spending in real time as part of the budget management process.

- The BGAs are adjusted once during the financial year, using the more recent OBR forecasts in the autumn.

Once UK Government tax revenues and social security spending for a financial year are known – normally a year after the financial year ends – the final BGAs are calculated, so there is a residual reconciliation.

In conclusion, the reconciliations process ensures that, at each Scottish Budget, adjustments are made so that the Income Tax net position and the BGAs for everything else are as they should have been, with the complexity that the adjustments relate to different years (three years prior for Income Tax, two years prior for the BGAs of everything else).

Watch the ‘How is the Scottish Budget funded?’ video below to better understand how reconciliations fit within the overall funding position.