27 January 2026

On Wednesday, we will be sending our response to the Scottish Government’s Climate Change Plan Consultation. Ahead of this, this Insight sets out how climate change can affect fiscal matters in Scotland. This Insight is based on Fiscal Sustainability Perspectives: Climate Change Mitigation – September 2025.

Introduction

The global climate is warming. Global temperatures in 2023 were estimated to have risen because of human activities by 1.3°C above pre-industrial levels. The effect of rising temperatures can be seen across Scotland and the world, with increased extreme weather and record temperatures.

There are three ways in which climate change can affect the public finances:

- Damage costs from climate change, through needing to invest in response to the harm caused by more intense and frequent severe weather events and potential loss of economic activity because of changes in the climate.

- Adaptation costs, such as infrastructure investment to reduce the likelihood or impact of climate change damage.

- Mitigation costs, which are actions taken to reduce global greenhouse-gas emissions to limit further global warming.

The amount that Scottish Government will need to spend on damage and adaptation costs may be reduced by investment in mitigation worldwide and how this limits the rise in global temperatures.

The OBR, in its latest Fiscal risks and sustainability report, says that keeping global temperature rises to only 2°C above pre-industrial levels is increasingly unlikely and that the temperatures will only be kept under 3°C in its central scenario. The under-3°C scenario would place significant pressures on the public finances, because of temperature rises, increased extreme weather events, and loss of productivity. The OBR report estimates that climate damage under this scenario could lead to a real-terms drop of 8 per cent in UK GDP by the early 2070s. This could potentially give rise to significant pressure for UK and devolved governments as they juggle responses to the damage with anticipated lower tax revenues due to reduced economic activity.

So far, our work on climate change has focused on mitigation. In 2019, the Scottish Parliament set the target for Scotland to reach net zero by 2045. The rest of this Insight will explore the investments costs that we have estimated for climate mitigation to meet the parliamentary obligations in Scotland and what this could mean for the Scottish Budget.

Mitigation and Scotland’s Fiscal Context

Mitigation costs arise from actions to reduce greenhouse gas emissions such as:

- Improving the insulation in buildings so they require less energy to heat

- Planting more trees to remove carbon from the air

- Payments to encourage the use of low-emission vehicles

- Investment and creation of technologies that can remove greenhouse gases from the atmosphere.

How much and how fast emissions reduce depends on both reserved and devolved policy areas. As Scotland accounted for 9 per cent of the UK’s emissions in 2023, reducing emissions in Scotland counts towards UK net zero targets. Funding available to the Scottish Government is also influenced by UK policy decisions in areas equivalent to those devolved in Scotland, through the Block Grant.

Updated Mitigation Costs

We have used Climate Change Committee data published in 2025 to look at the expected investment costs of reaching net zero. The Climate Change Committee estimate of the additional amount of money that would need to be spent on capital investment in Scotland to be £68 billion in total (2024 prices) from 2026 to 2050.

The investment will need to come from both the private and public sector. For example, private energy companies are investing in the electricity network which means the private sector covers most of the investment in this area, while large amounts of the spending on lowering emissions from buildings is expected to be funded by the public sector.

We have considered whether expected public spending is in areas devolved to the Scottish Parliament or reserved to the UK Parliament. The expected public investment is concentrated in devolved areas. Approximately 81 per cent of public mitigation spending to 2050 is expected to fall in devolved areas.

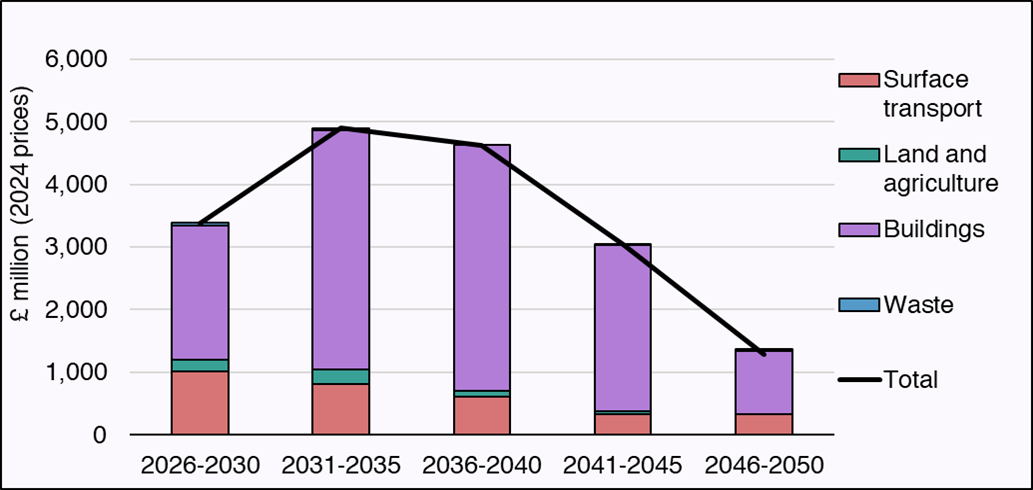

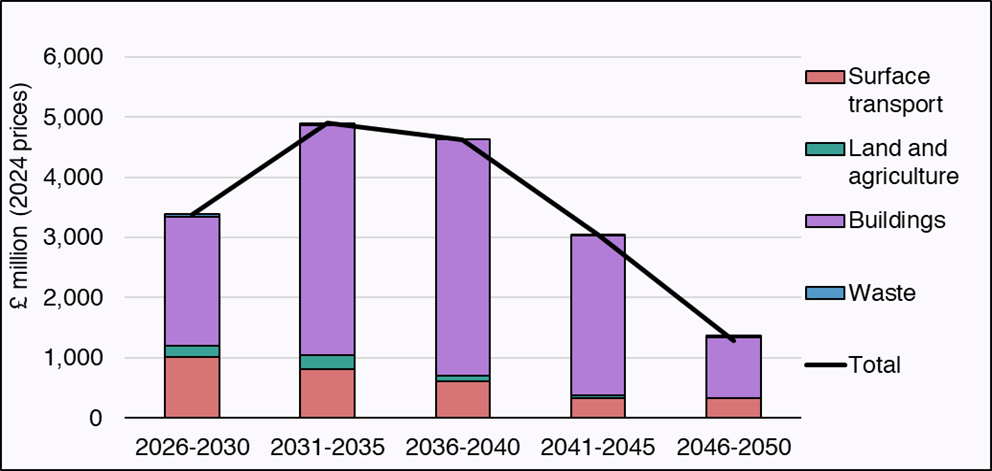

Figure 1 shows the main components of the anticipated investment required in devolved policy areas.

Figure 1: Devolved additional public investment, by sector, Scotland

Buildings are expected to be the largest area of public investment among devolved sectors

We have compared expected public spending in Scotland with the equivalent investment in devolved areas in the rest of the UK.

Public spending required in devolved areas is expected to be 26 per cent more per person in Scotland than in the rest of the UK between 2026 and 2050. This is mostly driven by expected higher spending needed per person on buildings as Scotland is colder and has a higher proportion of social housing than the rest of the UK The funding received from the UK Government would not be sufficient to cover the total costs of mitigation and additional funding would have to be found from elsewhere in the budget.

Uncertainty in mitigation spending

Mitigation spending estimates are subject to significant uncertainty. This is partly due to:

- Possible changes to policy

- Connection between Scottish and UK Government actions,

- The speed at which new climate mitigation technologies are developed and rolled out

These uncertainties mean that the Scottish Government may face higher, lower or more volatile public investment requirements than currently expected.

Further information can be found in our report Fiscal Sustainability Perspectives: Climate Change Mitigation. Tomorrow we will publish an Insight summarising our response to the Scottish Government’s Climate Change Plan.