8 January 2026

When any government sets a Budget, it is usually based on forecasts of revenues and likely spending. In Scotland the forecasts are prepared by the Scottish Fiscal Commission.

Our third Insight discusses some of the implications of having more parts of the budget which are variable and can be different to forecasts as well as the tools available to the Scottish Government for managing its Budget.

The role of forecasts

As the Scottish Budget is set before the start of the financial year, it is based on a set of forecasts.

As Scotland’s independent fiscal institution, we at the Scottish Fiscal Commission are responsible for forecasting the devolved tax revenues the Scottish Government receives. We also forecast how much we expect the Scottish Government will spend on devolved social security payments.

The Office for Budget Responsibility (OBR) also forecast equivalent UK tax revenues and social security spending which are used to set the Block Grant Adjustments (BGAs).

Forecasts can only ever be best estimates when they’re produced and will almost inevitably be wrong. Other parts of the Scottish Budget can also vary in‑year, for example funding from the UK Government might increase or decrease and the Scottish Government can change its spending plans during the year.

Tools for managing forecast error

Because of the uncertainty associated with any forecast, the fiscal framework included some tools for the Scottish Government to manage its Budget in the event of forecast error and to smooth funding between financial years.

Borrowing

The Scottish Government has some limited scope to borrow to spend more in any one year. However, the loans carry interest and must be repaid from budgets in future years. The Scottish Government can borrow within set limits and since 2024-25, these limits increase with inflation.

If the Scottish Budget is worse off because of forecast errors in devolved taxes and social security it is possible for the Scottish Government to borrow to smooth their resource funding (this covers day-to-day spending on public services and paying public sector workers). The annual limit for resource borrowing is £629 million this year and up to a total limit of £1,834 million. As we discuss below the errors can arise in our forecasts or in the corresponding Office for Budget Responsibility (OBR) forecasts for UK Government spending that feed into the BGA calculations discussed in our second Insight.

The Scottish Government can also borrow for capital spending (for building and maintaining public assets like schools, hospitals and roads) up to an annual limit of £472 million (in 2025-26) as long as the total amount borrowed remains below £3,145 million (in 2025-26).

Reconciliations

When setting the Scottish Budget, the devolved tax revenues and social security spending, and their BGAs, are all based on forecasts. We produce the forecasts of devolved tax revenue and devolved social security spending for Scotland. For the BGAs, the Office for Budget Responsibility (OBR) produces forecasts of the equivalent taxes and benefits in the rest of the UK.

Because so much of the funding for the Scottish Budget is now based on forecasts, there is a need to “reconcile” these forecasts with how much is actually collected in taxation or spent on social security. These are known as “reconciliations” and can be positive or negative. If negative, as mentioned above, the Scottish Government can borrow to help smooth the reduction to funding.

Reconciliations take place to different timescales. For example, the Scottish Government manages forecast error for fully devolved tax revenues and social security spending in real time as part of their budget management process. Income tax is treated differently. Because final receipts are not known until 15 months after the end of the financial year, the Budget is protected from in-year changes in income tax forecasts. Once the Budget is set, income tax revenues and the income tax BGA are not changed until outturn data is available and a reconciliation is applied to a later budget.

Scotland Reserve

The Scotland Reserve is a bit like a savings account. If spending in any year is lower than planned, the “underspend” can be stored in the Scotland Reserve. There is one account for each kind of funding: resource (day-to-day spending), capital (investment in assets), and financial transactions (lending to the private sector).

The reserve’s overall limit of £734 million in 2025-26 rises in line with inflation. Within that overall limit any amount can be used for the resource, capital or financial transactions accounts. The Scotland Reserve’s relatively small size compared with the overall budget means it can’t be used to save up for large, future investments, and is used more for managing budgets between years from underspends.

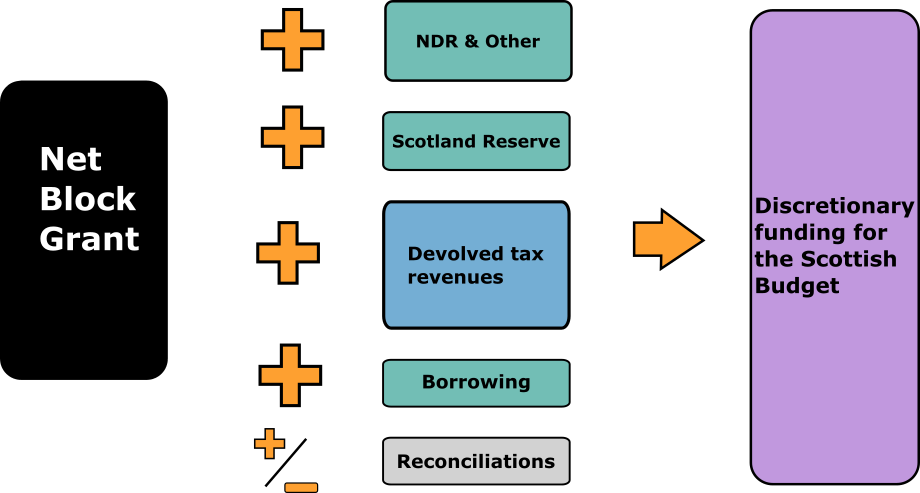

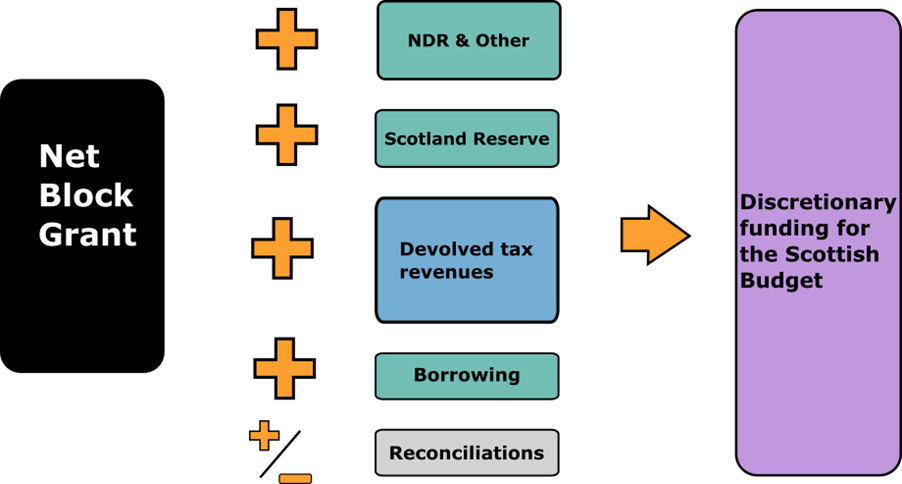

Figure 1: Funding sources covered in the Fiscal Framework

Crown Estate Revenues

Since 2022-23 proceeds from the ScotWind leasing programme run by Crown Estate Scotland, and other smaller Crown Estate Scotland programmes, have provided a source of funding which the Scottish Government can use at its discretion and can hold separately to the Scotland Reserve. This provides another tool for the Scottish Government to manage its budget.

At the start of this financial year (2025-26) the balance available from Crown Estate revenues was £713 million. The Scottish Budget next week will report the latest remaining balance available for future financial years.