7 January 2026

Our first SFC Insight looked at the Scottish Budget, including the additional powers devolved from the UK Parliament for taxation and social security.

This Insight looks at how the Scottish Budget is funded.

Additional powers, but some things haven’t changed – the Block Grant and Barnett formula remain in place

It is important to remember that even with additional tax powers, the largest funding source for the Scottish Budget is still the “Block Grant” which is a transfer from the UK to the Scottish Government.

The size of the Block Grant is set at each UK Budget. The grant is calculated by taking the amount the Scottish Government was given the previous year – we call this the “baseline” – which is then topped up or reduced using the Barnett formula, a mechanism which has been in place since the late 1970s.

When the UK Government changes its spending in devolved areas this results in Barnett consequentials for the Scottish Government which are added to the Block Grant. For example, health is devolved so if the UK Government increases health spending in England, the Scottish Government receives a population share of that increase in spending. Changes in spending in reserved areas such as defence, do not lead to any changes in the Block Grant.

Barnett consequentials can be positive or negative depending on whether it’s a cut or an uplift to a UK Government department’s budget. Importantly, additional Barnett consequentials for Scotland can be spent on any devolved area.

New powers required new funding arrangements

With the devolution of new powers over taxation and social security in 2012 and 2016, there was a need for new funding arrangements to be put in place. This came in the form of the Fiscal Framework agreed between the Scottish and UK Governments.

The Fiscal Framework defines the structure and the rules for the operation of Scotland’s devolved budget. Originally agreed in 2016, it has since been updated following a review in 2023.

It sets out the funding arrangements for the Scottish Government, including:

- How the “Block Grant” from the UK Government is adjusted for the devolution of social security and tax powers. These are known as Block Grant Adjustments (BGAs).

- Tools for investment and budget management – borrowing powers and the ability to hold reserves.

Fiscal Framework arrangements for social security

Following Scotland Act 2016, the UK Government has gradually transferred responsibility for some social security benefits to the Scottish Government.

As a result the UK Government gives additional funding to the Scottish Government as it no longer has to pay for those benefits. The amount transferred is an estimate of how much the UK would have spent on the payments if they hadn’t been devolved. These are called social securityBlock Grant Adjustments (BGAs).

The starting point is how much was spent in Scotland on each benefit in the year before it was devolved. That amount is then changed in line with trends in the equivalent benefits in England & Wales, where social security policy remains under the UK Government’s control. The indexation methodology used includes an adjustment for relative population growth.

Where the Scottish Government spends more on social security than the funding it receives from the BGAs, or introduces new payments with no UK equivalent, like the Scottish Child Payment, the additional funding needs to be found from other parts of the Scottish Budget.

Fiscal Framework arrangements for tax

In a similar way to devolved social security, since the UK Government no longer receives tax revenue that now contributes directly to the Scottish Budget, it makes a deduction to the Block Grant (known as the tax Block Grant Adjustment).

This adjustment is an estimate of what the UK Government would have raised if the taxes hadn’t been devolved. The tax revenue in Scotland the year before devolution is the starting point, and then the BGAs change in line with trends in the equivalent taxes in England & Northern Ireland where tax policy remains under UK Government control. Like Social Security, the calculation includes an adjustment for relative population growth.

Devolving tax and social security has changed Scotland’s funding arrangements

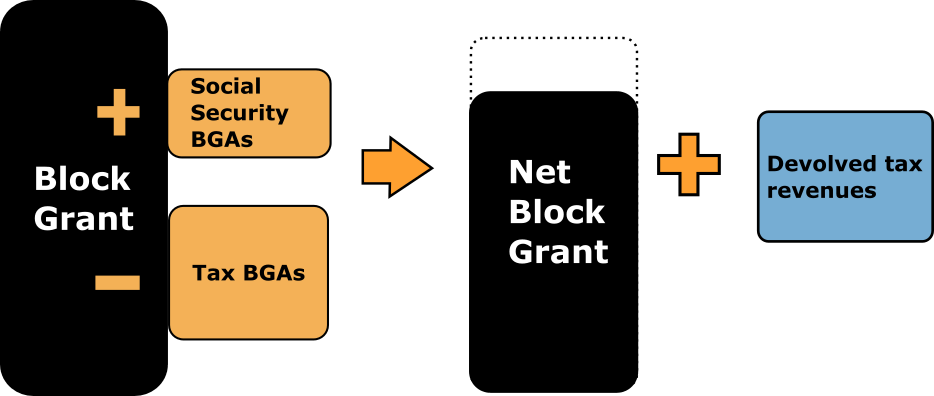

As shown below, the social security BGAs add funding to the Scottish Budget because the UK Government is no longer having to pay those benefits, while the tax BGAs remove funding from the Scottish Budget as the UK Government is no longer receiving those tax revenues.

As you can see in the diagram below, the Net Block Grant after the BGAs are included is smaller than the Block Grant because tax BGAs, which remove funding, are currently larger than the social security ones. For example, Scottish Income Tax revenue alone is several times greater than the value of the devolved benefits. The Net Block Grant still depends solely on UK Government policies, and the Scottish Government has no control over it.

Figure 1: Funding arrangements for tax and social security devolution

But, of course, we now need to add the devolved tax revenues into the mix. These are initially based on our forecasts which take account of Scottish Government tax policy.

In our third Insight we will look at how the SFC’s forecasts of tax revenue and social security payments are used in setting the Scottish Budget and how the Scottish Government can manage differences in tax revenues and social security spending to the forecasts.